0.00 р.

Оформить заказИнтернет магазин «Магнет-ВРН» предлагает неодимовые магниты по доступным ценам. Мы гарантируем безупречное качество каждого редкоземельного элемента, представленного в каталоге. Обратите внимание, что у нас действует гарантия низкой цены на изделия из неодима, найдете дешевле мы вернем вам 120% разницы в стоимости.

👉 Располагаемся по адресу: г. Воронеж, ул. 20-летия Октября, дом 75а (с правой стороны здания, во дворе, рядом со столовой). Выдача заказов осуществляется после оформления заказа на сайте. По всем интересующим вас вопросам звоните. Подробнее в разделе Контакты.

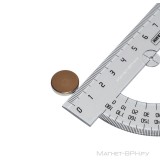

Неодимовый магнит впервые был создан в 1990-х годах и в настоящее время является самым мощным на планете. В его состав входят: неодим, бор, железо. После изготовления магнит дополнительно покрывают никелем для предотвращения негативного влияния окружающей среды.

Купить неодимовый магнит в Воронеже не сложно, просто позвоните нам. Цена напрямую зависит от количества, чем большее количество магнитов вы покупаете, тем ниже будет итоговая стоимость. Забрать товар вы можете самостоятельно или воспользоваться нашей услугой доставки по городу или в любую точку России. Стоимость доставки по городу начинается от 300 рублей.

Двухсторонний поисковый магнит ПМ F200x2

Двухсторонний поисковый магнит ПМ F200x2

Неодимовый магнит 50х30 мм

Неодимовый магнит 50х30 мм

Неодимовый магнит 45х25 мм

Неодимовый магнит 45х25 мм

Двухсторонний поисковый магнит ПМ F400x2

Двухсторонний поисковый магнит ПМ F400x2

Неодимовый магнит 15х3 мм

Неодимовый магнит 15х3 мм

Неодимовый магнит 40х10 мм

Неодимовый магнит 40х10 мм

Неодимовый магнит 8х2 мм

Неодимовый магнит 8х2 мм

Двухсторонний поисковый магнит ПМ F400x2

Двухсторонний поисковый магнит ПМ F400x2

Неодимовый магнит 45х20 мм

Неодимовый магнит 45х20 мм

Двухсторонний поисковый магнит ПМ F200x2

Двухсторонний поисковый магнит ПМ F200x2

Неодимовый магнит 40х20 мм

Неодимовый магнит 40х20 мм

Неодимовый магнит 70х30 мм

Неодимовый магнит 70х30 мм